According to The Wall Street Journal, Apple raked in 92% of all smartphone industry profits in Q1 2015. Last year, the Cupertino giant accounted for 65% of the industry’s operating income.

In terms of unit sales, the Cupertino giant accounts for less than a fifth of all smartphones globally. There are about 1,000 companies in the business of manufacturing smartphones worldwide.

Samsung came behind Apple with 15% of all the industry profits during the quarter. The two tech giants account for more than 100% if all profits, because most of their competitors have lost money or simply broken even during the period.

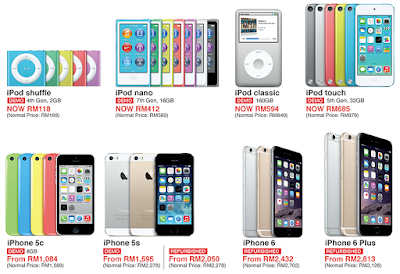

Higher prices are the main reason for Apple’s overwhelming profit dominance. The average iPhone price of $659 is over three times higher the $185 average price of an Android smartphone.

The Wall Street Journal hasn’t factored in sales data from privately owned companies such as Xiaomi and Micromax. However, their sales performance is not expected to alter the profit landscape significantly.

Going forward, there are plenty of reasons to believe that Apple will continue its industry dominance. The Cupertino giant is reportedly gearing up for record iPhone 6s launch with 85-90 million units ordered to suppliers.

Personally I wasn't such a great fan of iPhone till recently. The iPhone 6 is really exciting and I can't wait for the newer version and generation of iPhone in the coming months. I'm sure the next launch of iPhone will continue to capture the market share. Quite a few of the competitor's mobile phones are now somewhat similar to the iPhone 6. I guess that familiar look and feel for the iPhone 6 is really something that the public wants! Well done to design and creation of iPhone 6! Looking forward to many more great inventions from Apple!