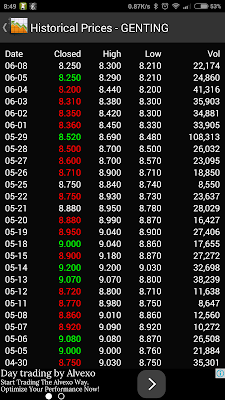

It was a bumpy ride with the GENTNG stock. At one point it was flying high at 8.52 and within the next few days, it tumbled back down to 8.25. Well there's a lot of factors why the overall share market ain't doing well but I would have expected GENTING to withstand them and continue moving up.

Good news for the GENTING investors today as the following article was released in The Star newspapers. With this piece of good news, I would expect the price for GENTING to move upwards again. Happy Trading!

The following is the article taken from Genting rated a ‘buy’, Malakoff 'outperform'

By UOB Kay Hian Research

Buy

Target price: RM10.90

LAST Friday, Genting Bhd’s share price closed at RM8.25, representing a 19% drop from its one-year high of RM10.22.

Genting’s share price notably fell 3.2% last week, ignoring the technical rebound of Macau gaming stocks.

Its warrants, issued on December 13, closed last Friday at RM1.43, below its issue price of RM1.50 (exercise price: RM7.96) and one-year high of RM2.98.

“Current valuations are compelling, and we continue to expect a series of moderate positives to re-rate the stock, including modest special dividends in this year’s 50th anniversary celebration, the opening of an iconic 20th century theme park by 49.3%-owned Genting Malaysia in the fourth quarter of 2016,” it said.

UOB Kay Hian Research said Genting’s present valuation did not ascribe any option value to the eventual opening of Genting Las Vegas or casino liberalisation in Japan,” the research house said.

There was the possibility that Japanese lawmakers could pass the casino legalisation bill in 2015 and 52.6% subsidiary Genting Singapore was regarded as a key contender for a casino concession, it added.

Genting traded at a prospective 2015 enterprise value/earnings before interest, tax (EV/EBITDA), depreciation and amortisation of 7.4x at the low end of its 7-24 EV/EBITDA range at a 9.4 average.

This was since 2011, the opening world of Resorts World Sentosa.

“We maintain our sum of the parts-based target price of RM10.90, which implies a 9.0x 2015 forecast EV/EBITDA,” UOB Kay Hian Research said.