Just sharing the superb earnings prospect for MITRA! Good luck and happy trading! The following article has been taken from Kenanga.

Initiating coverage on Mitrajaya Holdings Bhd (MITRA) with an OUTPERFORM rating and Target Price (TP) of RM2.35. We reckon that this under-researched stock is one of the good quality small-mid cap stocks with strong earnings growth visibility and compelling prospects. Key investment merits include: (i) superb potential earnings growth in the near-medium-term backed by record high orderbook achieved early this year, (ii) targeting to sustain the record-high orderbook by replenishing another RM1.0b new contracts this year, (iii) margin that is above industry average, (iv) being one of the potential beneficiaries of 11MP, (v) property division supported by strategic location of land (next to LRT stations), (vi) strong balance sheet with net gearing of 0.2x vs industry’s net gearing of 0.5x. Interestingly, despite the strong fundamentals, the stock is still trading at single digit PER valuation, i.e. Fwd-PER of 7.4x. This is relatively cheaper than that of small-mid cap contractors’ Fwd-PER range of 10-14x. Our TP of RM2.35 implies 9.4x PER that offers potential upside of 26.3%

Superb potential earnings growth. While we expect the group to approach the RM1.0b revenue mark in FY16, we forecast for MITRA’s earnings to grow by 47%-27% in FY15E-FY16E driven mainly by the group’s record high orderbook of RM1.9b achieved early this year coupled with sustainable margins.

Targeting to secure RM1.0b new jobs this year. YTD, MITRA has replenished RM230m worth of new contracts and management is targeting to secure another RM770m before the end of the year, to make up its total target of RM1.0b. Conservatively, we only forecast the group to secure RM700.0m this year. Hence, there could be further upside potential to our current earnings estimates.

Above-average construction margins. MITRA has consistently achieved pre-tax margins that are above industry average in its construction division. In FY14, MITRA delivered 9.8% PBT margin for its construction division, higher than that of sector’s PBT margin of 7.9%. The group is able to fetch higher margins as the group adopts value engineering and design while some projects are secured with good pricing.

To benefit from 11MP announcement. Among the key projects under 11MP that MITRA can participate are: (i) LRT3, and (ii) development of 606.0k affordable houses. We believe MITRA stands a good chance of securing those projects due to its track record. MITRA is currently building LRT extension stations. The group also has been building affordable houses for the government in Putrajaya. Latest project that it secured was earlier this year where it was appointed the main contractor to build RM230.0m PPA1M public apartments in Putrajaya.

Property division to be supported by strategic property location. We like the fact that MITRA’s property project in Wangsa 9 (Phase 1) achieved 70% take-up rate despite the challenging property market environment. We believe this is due to the strategic location of the land which is adjacent to a LRT station. Other than this, MITRA has another piece of land (15 acres) in Puchong Prima, which is also adjacent to an upcoming LRT station. Total GDV stands at RM1.5b which consist of mixed development project that going to be linked to the LRT station.

Strong balance sheet. The group’s net gearing ratio stood at 0.2x. This is relatively lower than that of the construction average net gearing of 0.5x. Strong balance sheet provides more room to gear up to invest for future growth.

Still trading at single digit valuation despite the strong fundamentals. Despite the solid investment merits, the stock is still trading at Fwd-PER of only 7.4x. This is relatively cheaper than small-mid cap contractors PER range of 10-14x. If the stock trade at 10.0x Fwd-PER, the stock’s market cap will be as high as RM1.1b on par with HSL, MUHIBAH, WCT and upcoming IPO SunCon.

Source: Kenanga Research - 24 Jun 2015

No pain no gain! Got to take some risks before you reap great returns! Happy Trading!

Wednesday, 24 June 2015

BIMB Research sees buying sentiment on Bursa returning soon

Good news for the Kuala Lumpur Stock Exchange! Hopefully with the maintained status from Fitch, it will further improve the confidence of the investors! Happy Trading!

Extract from The Star Business News.

KUALA LUMPUR: BIMB Securities Research expects buying interest on Bursa Malaysia to return soon as Fitch maintained its status quo on Malaysia with a A- (negative) in its latest report.

“With this uncertainty lifted, we thus expect sentiments on Malaysia to improve with the 1,730 as the immediate resistance,” it said on Wednesday.

Foreign funds were net sellers on Tuesday at –RM173.4mil while retail investors were net sellers at –RM2.1mil while the selling was well absorbed by local funds. The FBM KLCI lost 5.90 points to close at 1,726.86 as foreign selling persisted.

Overnight on Wall Street, traders continued with their long on equities riding on the “feel good” sentiment following solid US home sales figures and that Greece is edging closer to a solution soon.

On the back of a relatively quiet trading session, the DJI Average rose 24.29 points at 18,144.07 with the Nasdaq closed on another record high at 5,160.10.

In Europe, shares climbed across the board on expectations that Greece debt impasse may be finally over. Asian markets were generally higher except for those in the SEA region as foreign selling remained apparent.

Saturday, 20 June 2015

Protect yourself against Middle East Respiratory Syndrome [MERS]

Message from World Health Organization (WHO)

Protect yourself against Middle East Respiratory Syndrome [MERS]

If you have fever (38 degrees Celsius and higher), cough or difficulty in breathing, contact your nearest health care provider #MERS

Protect yourself against Middle East Respiratory Syndrome [MERS]

If you have fever (38 degrees Celsius and higher), cough or difficulty in breathing, contact your nearest health care provider #MERS

Source Images : World Health Organization (WHO)

Tuesday, 9 June 2015

More good news for GENTING stock!

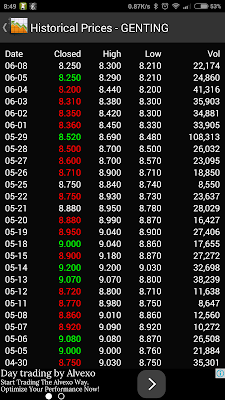

It was a bumpy ride with the GENTNG stock. At one point it was flying high at 8.52 and within the next few days, it tumbled back down to 8.25. Well there's a lot of factors why the overall share market ain't doing well but I would have expected GENTING to withstand them and continue moving up.

Good news for the GENTING investors today as the following article was released in The Star newspapers. With this piece of good news, I would expect the price for GENTING to move upwards again. Happy Trading!

The following is the article taken from Genting rated a ‘buy’, Malakoff 'outperform'

By UOB Kay Hian Research

Buy

Target price: RM10.90

LAST Friday, Genting Bhd’s share price closed at RM8.25, representing a 19% drop from its one-year high of RM10.22.

Genting’s share price notably fell 3.2% last week, ignoring the technical rebound of Macau gaming stocks.

Its warrants, issued on December 13, closed last Friday at RM1.43, below its issue price of RM1.50 (exercise price: RM7.96) and one-year high of RM2.98.

“Current valuations are compelling, and we continue to expect a series of moderate positives to re-rate the stock, including modest special dividends in this year’s 50th anniversary celebration, the opening of an iconic 20th century theme park by 49.3%-owned Genting Malaysia in the fourth quarter of 2016,” it said.

UOB Kay Hian Research said Genting’s present valuation did not ascribe any option value to the eventual opening of Genting Las Vegas or casino liberalisation in Japan,” the research house said.

There was the possibility that Japanese lawmakers could pass the casino legalisation bill in 2015 and 52.6% subsidiary Genting Singapore was regarded as a key contender for a casino concession, it added.

Genting traded at a prospective 2015 enterprise value/earnings before interest, tax (EV/EBITDA), depreciation and amortisation of 7.4x at the low end of its 7-24 EV/EBITDA range at a 9.4 average.

This was since 2011, the opening world of Resorts World Sentosa.

“We maintain our sum of the parts-based target price of RM10.90, which implies a 9.0x 2015 forecast EV/EBITDA,” UOB Kay Hian Research said.

Saturday, 6 June 2015

Asian Snacking Habits

I came across this article from YouGov and I felt it was something I should be sharing. Across Asians, we love to have snacks and that might be the contributing factor on why we Asians are overweight. Something that you might want to review if you are snacking much in between your meals.

91% of Asians have snacking habits and 24% are snacking on a daily basis

(Snack Frenzy), with women being the majority (57%).The top 2 countries

with most snack frenzy are Indonesia (24%) and Australia (17%)

Browse to https://ap.yougov.com/en/infographic/ for more interesting facts!

Have a great weekend peepz!

Tuesday, 2 June 2015

My Pick | MITRA & GENTING

KLSE opened today in a slightly weak fashion. I still see two great opportunities out there and it is lying with GENTING and MITRA.

The price of the GENTING stock for me is the right time to stock up and I've already done so. I predict in the coming weeks, the price of GENTING will steadily increase and that should bring a handsome profit for us all. Got to be patience at times as the stock price won't increase with a huge profit overnight.

MITRA is still riding on the good news from the company's announcement for the bonus shares. As you can see the investors are still purchasing this stock and the share price has rose to nearly 10 cents in the past couple of days! I believe it is still capable of increasing as much as the investors.

Good luck to us all and happy trading!

Monday, 1 June 2015

More opportunities from KLSE - MITRA & GENTING

Even though the index for KLSE continued to dip down but there is always opportunities! I strongly believe in it and I shall continue to look for the opportunities to make some money.

MITRA responded well to the news released on Friday. The market confidence was clearly seen and I believe the share will continue to rise in the next few weeks. A money making company is giving out bonus shares and also free warrants. I would say it is a good deal definitely.

BJAUTO also released similar news to MITRA. They will be proposing the bonus shares for their investors which in other words describe good news for the investors. No wonder the share price jumped up 10 cents today!

AIRASIA released the quarterly results and it was a great quarter for them. The share price rose nearly 18 cents since the release of the fantastic news. The share is clearly undervalue with the recent dip in price. It was a great buy from the past week though.

GENTING released their first quarter's results. Even though the results were within their projected earnings, there will be more opportunities for the share to rise.

At this point of time, I still believe that GENTING is a good buy and it seems like the right time to buy when the share price is low. The last time GENTING was at this price, it was around mid March 2015. Good luck to you all and happy trading!

MITRAJAYA HOLDINGS BHD

With earnings these days, it is not sufficient to have a steady savings. People will resort to other sorts of income through investment either through share investment or mutual funds. I prefer to monitor the progress of my investments and I personally like the share investment. Although there might experts saying that it might not be the right time to invest, I believe the time is right if you have done your research on the company.

Allow me to share with you one of my findings which is for the company of Mitrajaya Holdings Berhad.

Results

- Mitrajaya posted 1QFY15 results with revenue of RM161.6m (+55% YoY, +19% QoQ) and earnings of RM13.4m (+23% YoY, -17% QoQ).

Deviation

- 1Q earnings made up 17% of our full year forecast which we regard as inline. Traditionally, 1Q tends to be the weakest quarter given slow construction progress due to the Lunar New Year festivities. To illustrate, in the past 3 years, 1Q only made up 16%, 12% and 20% of full year earnings.

Dividends

- None. Usually declared in 4Q.

Highlights

- Strong orderbook support. Construction work appears to be progressing well with division revenue up +82% YoY and +51% QoQ. Its orderbook currently stands at RM1.8bn, translating to a superior cover of 4.7x FY14 construction revenue (peers average: 2.1x). Momentum is expected to further accelerate in the coming quarters as newer jobs such as the PP1AM housing (RM230m), BNM complex (RM187m), MK22 (RM402m) and Raffels School (RM270m) gain traction.

- Gunning for more. YTD job wins currently amount to RM230m vs. management’s full year target of RM1bn and our more conservative assumption of RM500m. Total tenders currently stand at RM1.9bn comprising buildings in the Klang Valley (RM1.4bn) as well as buildings (RM350m) and infra works (RM180m) in Johor. Aside that, Mitrajaya is also a strong contender for the LRT3 station works (RM750- 1,000m) which should take off in 1Q16.

- Efforts to boost sales. While take up rate for Phase 1 (RM185m) of Wangsa 9 has hit 70%, it has been much slower for Phase 2 (RM195m) at only 17%. In efforts to boost sales, last weekend, Mitrajaya conducted an official launch for Wangsa 9. It is also mulling to engage property agents and advertising to shore up sales.

Risks

- Delays in construction execution and softening property market.

Forecasts

- No changes to estimates as the results were inline.

- We maintain our earnings projections and believe that FY15 will be another record earnings year (+49% YoY) for Mitrajaya.

Rating

BUY, TP: RM2.92 (+55% upside)

- Mitrajaya remains our top pick amongst the small cap contractors as it offers robust growth prospects (3 year CAGR: 24%) at inexpensive valuations of 9.4x and 7.8x FY15-16 P/E.

- Dividend yield is also decent at 3.7-4.5% for FY15-16, respectively.

Valuation

- Our SOP based TP of RM2.92 implies FY15-16 P/E of 14.7x and 12.2x respectively.

Source: Hong Leong Investment Bank Research - 26 May 2015

Late last week, there is an announcement to the shareholders again with more good news.

Today the market responded well to the decisions from MITRA. The share rose in the early trading and I expect this trend to continue for the next few days.

For all the share investors out there, what do you think of the potential of this share? Looking forward to share your views. Good luck to us all who have invested in this share as we sit back and wait for the EGM to take place next month. Happy Trading!

Subscribe to:

Posts (Atom)